ESG due diligence for M&A transactions: Identifying risks and opportunities

Environmental, social, and governance ("ESG") issues increasingly influence dealmaking and M&A transactions. Buyers are becoming acutely aware of how ESG diligence can identify various risks and opportunities that may affect a target's valuation in ways not readily identified by traditional due diligence. Furthermore, buyers understand the need to consider the impact of increased regulatory, investor and customer requirements on a target's activities.

Risk Considerations

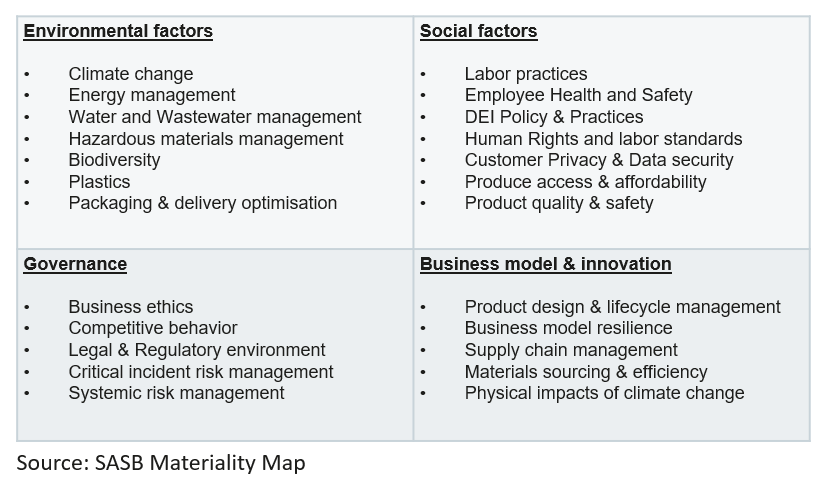

ESG diligence views a target’s risk profile by evaluating ESG factors reasonably likely to materially affect a company's financial condition, operating performance, or market valuation. Material ESG factors are identified using Sustainable Account Standards Board (SASB) standards, which have been adopted by the International Sustainability Standards Board (ISSB). By incorporating ESG information into investment decisions, buyers can bring to light risks often overlooked by traditional due diligence.

Areas of risk vary by industry but usually touch upon climate, energy, waste, safety, supply chain, and local community concerns. Examples of ESG risk include:

- How hazardous waste is handled and disposed of can significantly increase buyer/lender liability exposure.

- Workplace injuries and other safety-related issues increase a company’s exposure to ligation and work stoppages.

- Human rights violations in a supply chain can increase reputation risk and incur government sanctions.

Generally speaking, business activities exposed to fines, ligation, labor unrest, government sanctions, or reputational damage are areas where ESG diligence can help a buyer better understand a target company’s risk profile, and as shown below, failure to consider ESG risk can result in a complete investment write-off.

Case Study – Indigency Rights

In 2021 Norway’s Supreme Court ruled that a billion-euro windmill park in the Sami Area violates Sami’s indigenous rights. The court ruled that the installation of a wind turbine park that prevents or limits Sami’s exercise of reindeer husbandry violates their indigenous rights and must be removed if a mitigating solution is not found. Had investors weighed the importance of Norwegian indigence rights in their pre-investment due diligence, they would not be facing a complete loss on their investment today.

Opportunities Considerations

ESG diligence not only identifies potential risks but can help identify longer-term opportunities for cost savings, revenue growth, and improved efficiency. This is especially true as consumer preferences and government priorities move toward sustainable products and align with the transition toward a low-carbon economy. Buyers incorporating sustainability in their valuation models can better quantify long-term value and capitalize on sustainability trends that significantly enhance an investment’s terminal value.

Areas of opportunities generally centre around a company’s production methods, products sold, customer base, and environmental Impact. Examples of opportunities include:

- A resort operator looks to re-establish local biodiversity in its grounds and surrounding area to increase its attractiveness to guests. This also resulted in a secondary revenue stream from selling carbon credits, further adding to the projected exit valuation.

- A concrete manufacturer whose customers are located in the EU creates an innovative process that reduces concrete’s carbon footprint by 85% while matching the strength and cost of traditional high-carbon concrete.

- A REIT buys several brownfield properties taking advantage of “green” government subsidies and tax credits when structuring the transaction and evaluating future capital investments.

- A buyer identifies how an online delivery target company can redesign packaging to reduce costs and materials by 50%. Further supporting their deal rationale.

Case Study – Innovative Processes

Much of the world’s Lithium is located in South American deserts and harvested through a process known as brine extraction. Brine extraction involves pumping 500,000 gallons of lithium brine to the surface to create one ton of Lithium. The dissolved brine is pumped into evaporation pools, where it takes almost two years for the pools to evaporate while only recovering 20-40% of the extracted Lithium. Brine extraction is extremely water-intensive, resulting in significant hardship to the local farming communities.

To make Lithium mining more sustainable, several companies have developed and patented a new Direct Lithium Extraction (DLE) process. DLE is a process that uses a highly selective absorbent to extract Lithium from brine water and transfer it into a different medium for further processing. It is a low-cost, high-efficiency, and environmentally friendly way to produce high-grade Lithium and can reach a 90% recovery rate. DLE technology speeds up the Lithium concentration process, recycles water used in the process, and reduces the need for large evaporation ponds.

To overcome community opposition, Standard Lithium successfully implemented DLE in its Arkansas mining operations and is now using it as a model for future mining opportunities.

There are many ways long-term opportunities are identified in a deal. Sometimes it’s the seller’s ESG statements, and other times it’s an ESG specialist identifying an opportunity that the deal team should explore. Most unsustainable activities can become sustainable at some cost. The question is, does the target have an innovative, sustainable solution with a positive return?

Regulatory & Customer Considerations

Governments and customers are imposing significant sustainable standards on companies that operate in their jurisdictions or supply chain. These rules apply not only to local operations but also to their upstream and downstream impacts.

The European Union created the EU Taxonomy classification system for sustainable business activities to support the transition to a more sustainable economy. Among many things, the EU Taxonomy identifies sustainable activities by industry that “do no harm.” Because of how the SFDR (reporting directive for Alternative Investment Fund Manager (AIFM) ) and EU Taxonomy interconnect, investments in the “do no harm” category have a significantly larger EU audience at the exit. In the context of M&A, buyers can use the EU Taxonomy to assess its impact on a potential target company and identify opportunities for value creation and risk management.

In the USA, the SEC has published several ESG proposals. The most far-reaching proposal is that all public companies make certain climate-related disclosures. These disclosures include reporting on greenhouse emissions and climate-related risk exposure. The climate reporting proposal incorporates The Task Force on Climate-Related Financial Disclosures (TCFD) framework, which most public companies still need to adopt. Understanding climate implementation costs and how such reporting may influence future valuations should be considered during the M&A process.

Suppliers also are feeling pressure from both their customers and regulators. Target companies that supply public companies need to be able to explain their policies and procedures related to human rights, diversity, and greenhouse gas emissions targets. Companies buying cotton and solar panels must consider the USA’s Uyghur Forced Labor Prevention Act and how compliance is documented.

Conclusion

ESG information should never be a sole or primary consideration for an investment decision. ESG diligence is meant to provide additional information when evaluating a transaction. By increasing the level of available information, buyers will have a more holistic view which may help them avoid bad investments and foster opportunities that enhance returns. It is also essential in today’s world to consider sustainability and equality during the investment process. Failure to consider these mainstream issues can create unexpected consequences that could have been avoided before closing.